Montana Self-Storage Market Update Review

Claire Matten | Advisor | CCIM | Sterling CRE Advisors

- Dropping interest rates

- Compressed cap rates

- Low vacancy

- Spiking demand

- Higher values

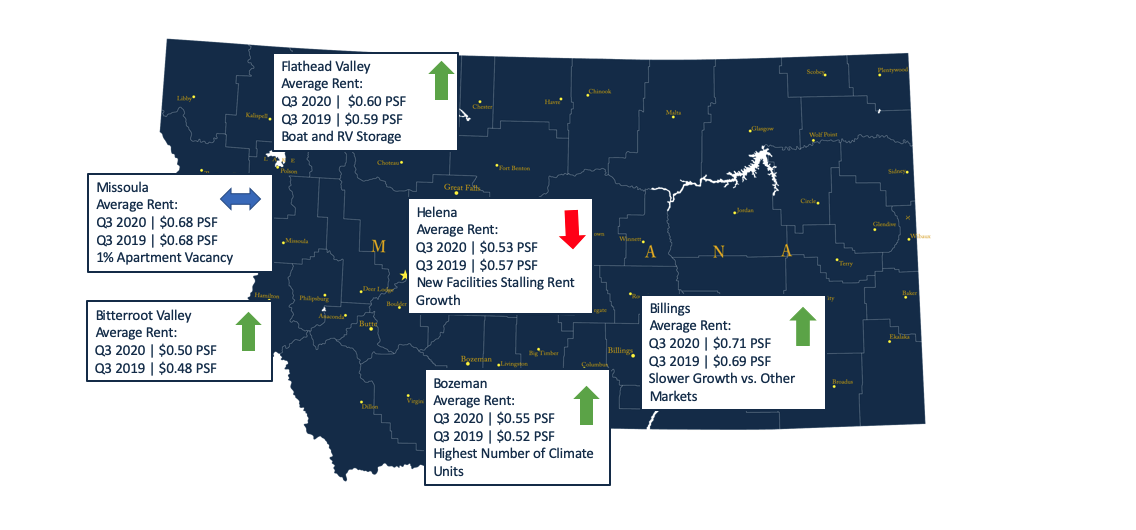

Around The State

In Missoula, limited footprint space and delayed construction have driven apartment vacancy to 1%. For some, property taxes are pushing some folks to live in the Bitterroot for the more favorable tax conditions and that’s just one of the reasons we likely saw a boost in rental rates in the Bitterroot year over year.

The Flathead Valley is collecting some of Montana’s net migration, which may be leading to the slight uptick in self-storage prices per square foot. With RV purchases through the roof across the country this summer I know you need RV storage up your way.

Bozeman has a housing crunch much like Missoula. As MSU continues to break enrollment records, more migration from larger markets pushes in, the demand for rental units remains high.

Helena has seen a drop in rates year over year but this is likely due to a rise in self-storage construction in recent years. Once these new facilities stabilize and the housing deliveries in Helena and East Helena continue, rent growth is likely.

Since the presentation, we’ve also heard that there are some climate controlled options in Helena, leveling up the overall competition in the area.

In Billings, demographics skew toward an older median age group in comparison to other cities which can sometimes impact rates and demand.

Forecast

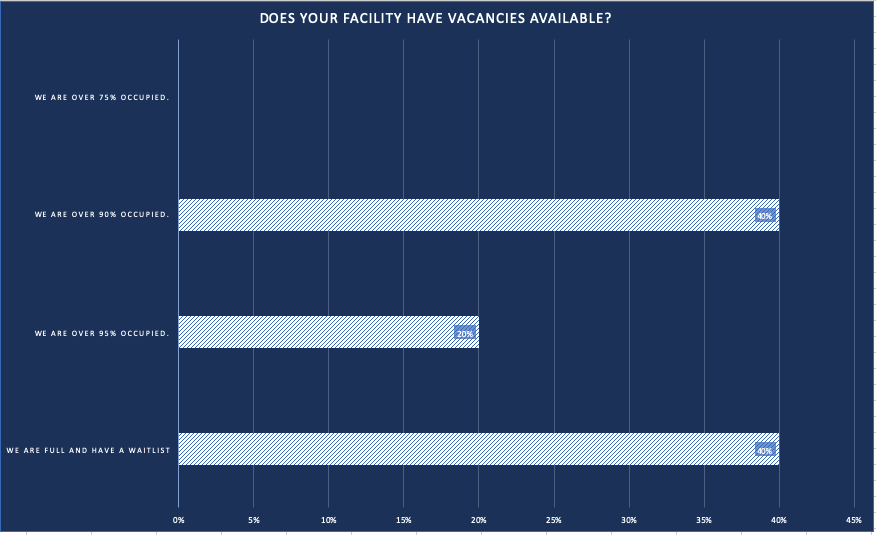

Market uncertainty is impacting all commercial assets- but self-storage is proving to be one of the most stable asset classes in a volatile market. Some investors view the asset as a “safe-haven.”

Investors are back to 2017-like attitudes making offers based on 3-year projections in some of the larger metropolitan markets.

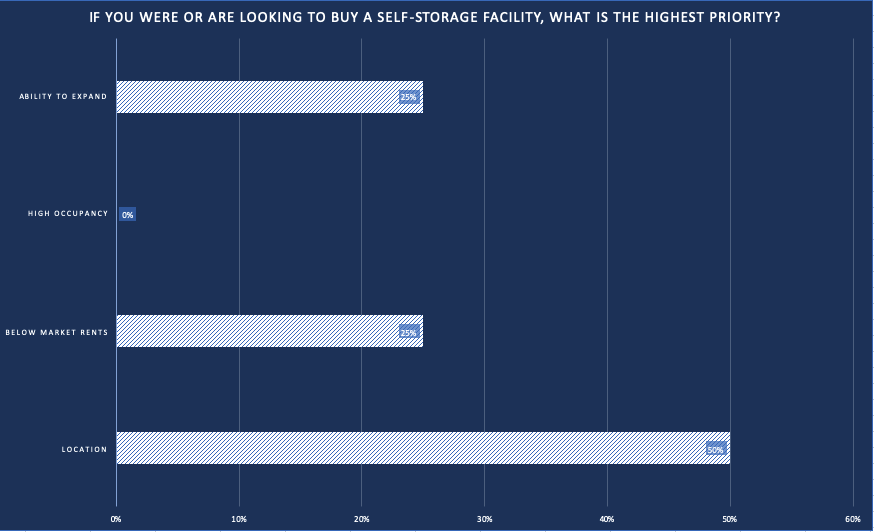

Looking to buy? There’s no wrong answer when it comes to priorities. SSA responses were mixed, but location was a clear winner.

The Hunt for “Institutional Product”

- At least 300+ units (preferably 500+)

- Expansion capability; excess land

- High end amenities including automated gates, security lighting, cameras, etc.

- Highway or main thoroughfare access and visibility

- On-site management office (with management team)

- Stabilized facility with little deferred maintenance

- Surrounding demographics

Emerging Development Trends

- Neighbor.com making headway in Montana markets

- Some cities, including those in Montana, making changes to zoning for self storage facilities

- Adaptive reuse projects transforming former big box stores to self storage

Questions? Contact Claire Matten for more information.