Stay Ahead of the Real Estate Cycle, Use Economic Base Analysis

You’ve no doubt heard and read all of the news about existing Missoula companies expanding along with additional firms looking to expand into our market. Savvy investors and developers pay very close attention to job growth trends to forecast where opportunities will likely be present in the near future.

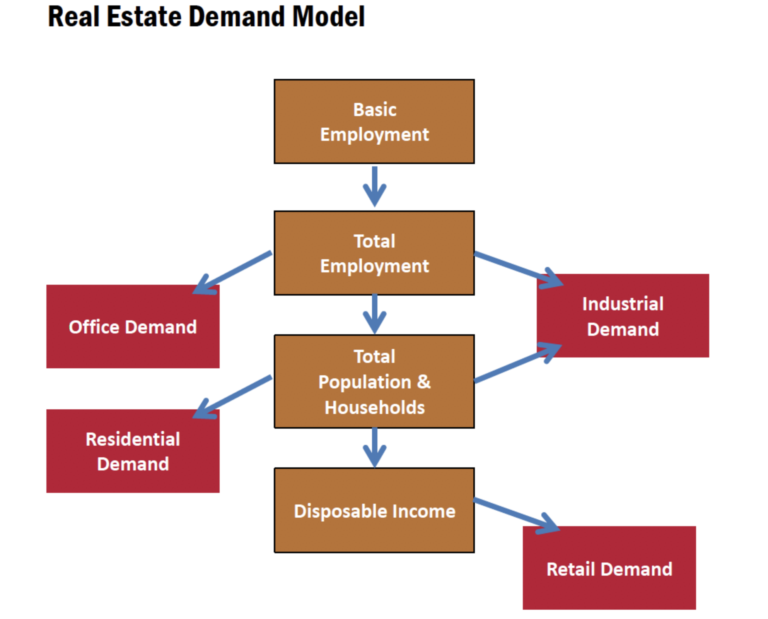

Here are the key components of the Real Estate Demand Model and how you can use them to plan your next move:

Understand the difference between Basic and Non-Basic Employment.

Basic employment is considered the economic base of an area. These are the jobs which produce enough goods and services that not only satisfy the needs of us here in Missoula, but also push consumption into outside communities. In doing so, basic jobs bring outside money back into the local economy and fuel the need for Non-Basic Employment. Non-basic jobs are those which service the local economy such as retail, banking, and utilities.

In conclusion: More Basic Jobs will drive the local economy and in turn are a major indicator of future commercial real estate demand.

Evaluate How Total Employment Impacts Your Community.

Total employment is the sum of both the basic and non-basic jobs. The total employment figure will ultimately drive current and future demand of office and industrial space. By dividing the total employment figure by the basic employment figure (total employment ÷ basic employment) you can calculate the Economic Base Multiplier (EBM) for your given community. The higher the EBM, the more economically diverse your community.

For example, if your EBM is 6.50, for each new basic job Missoula adds, an additional 5.50 jobs will trickle down into the non-basic sector. In short, if Missoula adds 100 new basic jobs, we would also gain 550 non-basic jobs and our local economy would grow by 650 new jobs. Keep in mind if Missoula were to lose 100 basic jobs it would pull a total of 650 jobs out of the community.

Determine Total Population and Households From Total Employment.

Using the data you’ve already collected in your job growth review, it’s important to calculate the Population to Employment Ratio (PER). By dividing the total population in your community by the total employment (total population ÷ total employment) you can distinguish how many additional residents will need housing and industrial space for every new job that enters the area. The PER for Missoula in 2017 was 1.97. By multiplying the PER by the EBM, one can predict the population growth derived by basic job growth (1.97 × 6.50 = 12.80 in population growth). This can help gauge the need for housing in the future.

Track Job and Population Growth to Forecast Housing and Retail Demand.

The Real Estate Demand Model tells us that total employment feeds into total population and household figures, which in turn trickle down into disposable income and additional retail demand. Self-storage, medical care, and a variety of retail goods and services are closely connected to the amount of disposable income available among local households.

In summary, the Real Estate Demand Model and Economic Base Analysis are tools which can assist you in making more informed investment and development decisions. In the quest to stay one step ahead of the market cycle, it’s important to stay informed on the forecasted job growth in your local community. At Sterling CRE Advisors we work to stay on top of current trends and consistently track new development throughout Montana. We are always available as a resource when analyzing your investment or development portfolio.