by Ross P. Keogh, MA, JD | Worden Thane P.C.

The 2017 Tax Act created a new economic development tool known as “Opportunity Zones.” 26 USC § 1400Z-(2). Opportunity Zones are census tracts that were selected by the Governor of each state in early 2018. The zones are fixed, and each state has at least 25 such census tracts. This mapping tool by Novogradac shows the location of all designated Opportunity Zones.

Under the 2017 Tax Act existing, new, or expanding businesses located in an Opportunity Zone can potentially enjoy the following two tax benefits:

(a) Deferral of gain on new investments in such business (and some free basis), and

(b) Avoidance of gain after holding such assets for ten (10) years.

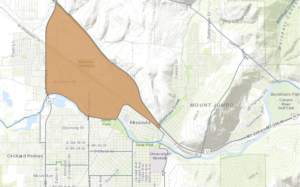

For example, here is the Missoula Zone:

The Deferral Benefit Explained

The Deferral benefit is similar to like-kind exchanges under Section 1031, however it is expanded to include virtually any capital gain event. So, the amount of capital gain from the sale of stock, goodwill of a business, or real property can be rolled into an Opportunity Zone business. In addition, an investor will receive a step-up in basis of 10% of the investment after holding the investment for five (5) years and an additional 5% step-up after seven (7) years.

However, the Deferral benefit stops on December 31, 2026, when gain must be realized.

The Avoidance Benefit Explained

For investors that hold an opportunity asset for ten (10) years all appreciation is tax free. By example, if an investor bought a qualifying business interest for $100,000 and then sold it for $200,000, the $100,000 of gain would be tax free.

The Avoidance and Deferral Benefit allow for businesses located inside an Opportunity Zone to have access to additional and cheaper equity to support the expansion of a business.

What qualifies as an Opportunity Zone Investment?

An Opportunity Zone investment is an interest in a partnership or a corporation, which has its “nerve center” located within an Opportunity Zone and which substantially improves its property as a consequence of the investment. Generally, substantial improvement will occur if the business doubles its assets within 30 months of the investment. Substantial improvement happens when the business acquires or improves tangible property (new vehicles, or new construction/renovation).

I am a business located in an Opportunity Zone, which should I be considering?

Expansion. Our modeling suggests that investors will be willing to support expanding businesses at 400-1200 basis points (4%-12%) below traditional rates. For instance, a property owner that has bare ground could bring in an investor to build out the property, allowing them to significantly increase the forecast return on their own investment. The original owner could then buy-back the property.

A growing business may also inadvertently qualify, and could make an election to be an Opportunity Zone business allowing the owners to sell the business after ten (10) years virtually tax free.

I am a new business, what should I be considering?

Locating in an Opportunity Zone. As a new business, your initial investment will almost certainly qualify as “substantial improvement.”

I am anticipating a capital gain, what should I be considering?

Rolling the gain into an Opportunity Zone investment. Such gain needs to be invested in an Opportunity Zone business within 180 days. There are some national hedge funds that are offering Opportunity Fund status. You may also consider starting a business inside an Opportunity Zone, or investing in an existing business which is looking for new capital. Once that investment is made, the new business has 30 months to substantially improve with the capital infusion.

Are there a lot of technicalities?

Not really, but any transaction will require some caliber of professional advice. Critically, investors do not need to be affirmatively certified by the IRS to participate in Opportunity Zone investments. However, businesses that want to have opportunity status must meet several investment targets and maintain their nerve center within the Opportunity Zone. Legal and accounting counsel can help make sure these requirements are met.

How Might An Investment Work?

Consider an investor (“O”) and a developer (“D”). D spends $200,000 to prepare plans and acquire real property for the construction of a warehouse within an Opportunity Zone. O sells stock with a gain of $200,000. O and D form a 50/50 partnership with O’s gain ($200,000) and D’s plans and property. The bank then provides $600,000 in construction financing, leaving $800,000 in funds for the construction of the warehouse. The partnership, because the bare ground was located in a zone and substantially improved, is an Opportunity Zone business. D avoids paying $60,000 in tax (which is invested in the zone). The warehouse’s tenant moves in on 1/1/2020, and starts paying rent (triple net) of $100,000 annually.

In 2024, O will get $20,000 in free basis, and then another $10,000 in basis in 2026. In 2026, when O is required to realize gain, the gain will be only about $48,000 in tax.

The partnership agreement between O & D provides that 25% of the income will be distributed to O and 75% to D, except that in 2026 O will also get a $48,000 distribution to cover its tax obligation, which is covered with additional project debt. We calculate that this arrangement produces a return of 10% for O and 20% for D before considering either the Deferral or Avoidance Benefit.

In 2030, after ten years, D buys out O and O realizes no gain under the Appreciation Benefit.

Please feel free to contact Ross P. Keogh* at Worden Thane P.C. to learn more about Opportunity Zones.

To call Ross directly, please click here.

*Licensed to practice law in North Dakota, Montana and Wyoming