The Crystal Ball for 2020

Everyone wants the inside scoop on what’s next. Whether in business, sports or politics, inside intel on what’s coming around the corner is both useful and interesting.

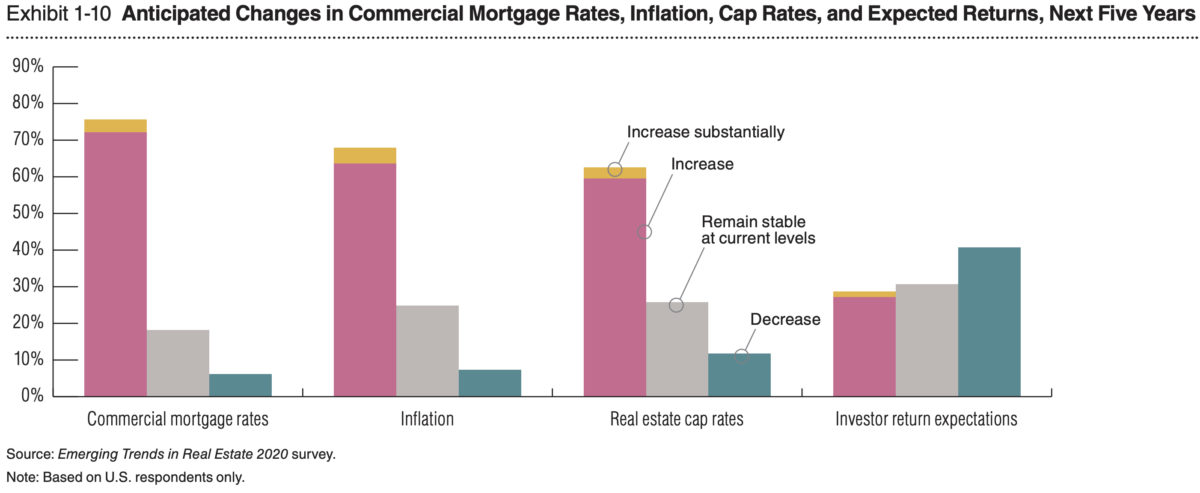

Each year, PWC puts out their Emerging Trends in Real Estate report that helps to set expectations on the commercial real estate market for 2020.

It’s probably not surprising to hear that, once again, PWC did not mention the Missoula, Kalispell or Bozeman CRE markets by name. Or anyone in Montana for that matter. It appears we haven’t quite made the cut yet for metropolitan areas to watch. Maybe next year Montana!

That slight aside, the larger macro trends in the economy most certainly can have an impact here in Western Montana. Here are three trends referenced in PWC’s report that will impact us here in Missoula, Kalispell and Bozeman:

Easing Job Growth

Projections by both the non-partisan Congressional Budget Office and by a multitude of private economists anticipate slowing GDP growth in 2020 and through the early part of the decade. During the peak of the post-2008 economic recovery, monthly job gains nationwide averaged 200,000 per month. Going forward, that number is expected to ease its way down closer to 45,000 – 50,000 jobs per month. As we discuss here, job growth is the fundamental driver of demand in the commercial real estate market.

A softer job market may lead to tempered demand for new commercial space in the future. It will become especially important in light of this anticipated trend in slower growth that investors and developers in commercial space have accurate intel on the market and what projects are planned and being delivered.

It’s important to note, though, that one way that Missoula may buck that trend is due to the “scenic premium” if offers. As companies like ClassPass, BusinessSolver and Bedrock Sandals discover Missoula’s quality of life and unique culture, continued job growth from these sorts of firms is likely. Though Missoula is not the cheapest place in the country, it’s still a great deal compared to most major east and west coast metropolitan areas. Plus, the accessibility of rivers, trails, skiing and all things outdoors make it very attractive as a place to set up a satellite office.

In addition, location-independent remote workers who specifically seek out places like Missoula, Kalispell and Bozeman as a place they want live is becoming an industry in itself and Western Montana is uniquely positioned to capture that market. Each “remote worker” job functions as an export industry job in its impact on the local economy. Generally, one export, or basic job, leads to several (as high as 6 in Missoula) other jobs being created in the local according to Economic Base Theory.

Flex is the future

It used to be that flex and co-working spaces were the domain of the “gig-economy” types: freelancers, creatives and entrepreneurs. However, even massive corporations are seeing the value of turning what used to be a fixed expense for their physical space into a variable cost through the use of flex space arrangements. Co-working, executive offices and a wide variety of hybrids along that spectrum now exist to provide users of commercial space with flexible options on price and term. From large corporations with a short-term contract to remote workers looking for a community to connect with, all are drawn to the amenities and cost effectiveness of flex space. Recent changes to lease accounting standards and its impact on the balance sheet of public and private companies alike are also feeding this trend toward “space as a service” as opposed to “space as an asset.” In the coming weeks, we’ll dig more into this trend and show how Missoula, Kalispell and Bozeman commercial property owners can benefit by embracing this concept.

Clamping down on costs

In an environment where rapid rent growth can no longer be counted on to make a investment pencil, disciplined and professional management of operating expenses will become increasingly important. While it always make sense to closely monitor an investment’s operating expenses, that will become especially true if rental growth rates start to level off. Focused management done by professionals will become more and more important in keeping your investment performing at satisfactory levels. Additionally, the use of data-driven revenue management techniques to minimize loss-to-lease in apartment and self-storage investments will set high-performing properties apart from the amateurs. Managers who focus on the growth of an asset’s performance rather than just keeping the bills paid and the building from falling down will prove their worth in the coming decade.

One thing is certain: change is inevitable. It pays to pay attention to what’s coming around the corner.

You’re invited to contact Sterling Commercial Real Estate to assist you in crafting a sound investment strategy for the next decade.