Hammers, nails, and engineered wood flooring have been flying at new apartment communities across Bozeman in 2023. Fast and furious construction is bringing needed new housing to market. This is good news for Bozeman’s tenants who have seen limited options and rising rents through 2021 and 2022.

Vacancy Rate

As we near the end of Q2 in 2023, Bozeman’s multifamily vacancy rate rose to 6.92%. It has increased by 3.14% compared to Q1 2022. The rapid increase in the vacancy rate is due to the delivery of 424 new apartments in the second quarter of 2023.

Click here for an interactive map of where the new units are located.

Rents

The average monthly rent in Bozeman is currently $2,140, which is down 3.67% from last year at this time. Notably, the rent per square foot is UP 5% year over year, this reflects the smaller size of units currently on the market. Renters will also find many landlords offering rent concessions. In most cases, one month free with a 12-month lease.

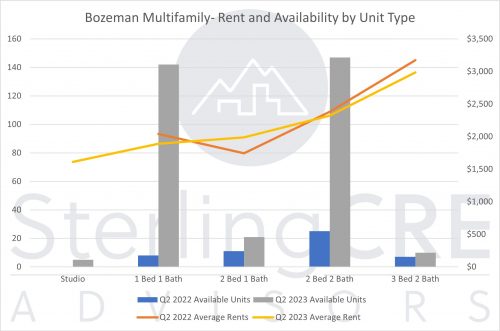

The chart below compares availability and rent by unit type between this year and last. Of note is the surge in availability of one and two-bedroom units. There has been little increase in the availability of three-bedroom units.2

Pipeline

A total of 1,133 units are currently under construction across Bozeman. An additional 568 units are in permitting. While many US markets have seen permitting pipelines fizzle out, Bozeman developers continue to move forward with projects.

Outlook

With a robust pipeline, it is expected that Bozeman’s vacancy rate will remain elevated. Rents will likely continue to drop across the market. Newly opened projects may not see significant rent drops. However, older class B and C projects may need to drop rents due to a more competitive market. Rent concessions often pull tenants from Class B and C properties into Class A properties as the price gap is decreased.

Interested in learning more about Bozeman’s commercial real estate outlook? Join the Sterling CRE team at Bozeman Market Watch on September 7. This in-person event will include a variety of industry experts discussing current and future market conditions. Email Info@SterlingCREadvisors.com for more information on how to sign up.